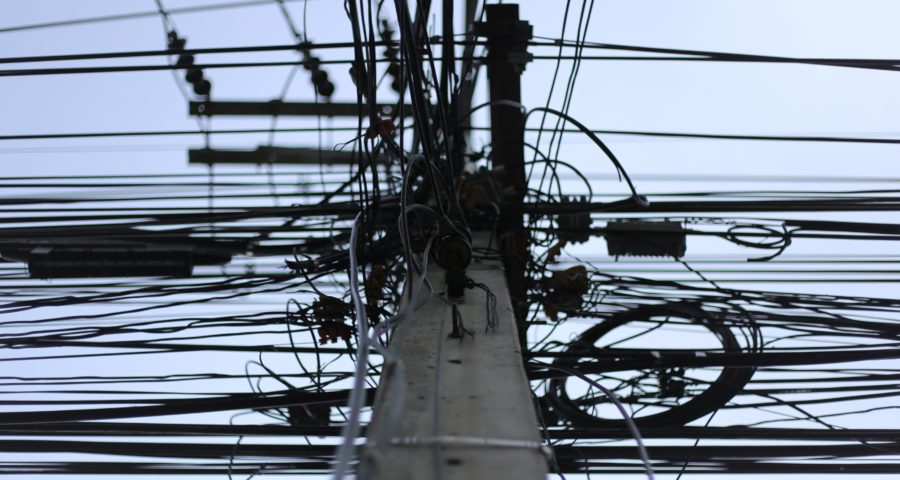

Is this a discussion you are having too frequently at your organization?

One of the most common challenges we see with new clients is this situation. Systems are often selected with individual and functional requirements in mind without anyone

looking out for the bigger picture of system and data integration. This can result in having multiple systems not talking with each other.

When we assess a systems portfolio, we first get an understanding of the ideal business process flow and identify data that needs to transfer from point A to point B and beyond. For

example, a company with a “quote to cash” business model has data originating from the quote that carries through the entire system to generate sales orders, purchase orders, and invoices. One point of data entry to fulfill multiple purposes. Sweet!

When there are several systems involved with this entire process, the business ends up duplicating data input or building expensive interfaces. This is not a scalable and sustainable model. And in today’s software market, there is no reason to continue working in this

manner.

As the software market continuously matures, the options for broader integration of functionality and data increase. While one big integrated system isn’t necessarily the answer for many companies, having fewer systems with automated integration can drive huge

efficiencies and greater profitability.

Unlike a financial portfolio, diversification isn’t recommended for a systems portfolio. Financial advisors work with you to build a healthy portfolio that protects your risks and maximizes your returns.

How healthy is your systems portfolio?

Photo by Amy Elting on Unsplash

Leave a Reply